When cancer strikes, the battle isn’t just medical—it’s financial. For many families, insurance cove...

When cancer strikes, the battle isn’t just medical—it’s financial. For many families, insurance cove...

October is Breast Cancer Awareness Month—a time for pink ribbons, survivor stories, and renewed focu...

When most people hear “life insurance in retirement,” they think final expenses. Advisors often defa...

Do you run to the top of the spreadsheet and quote another MYGA rate… or would you rather show your ...

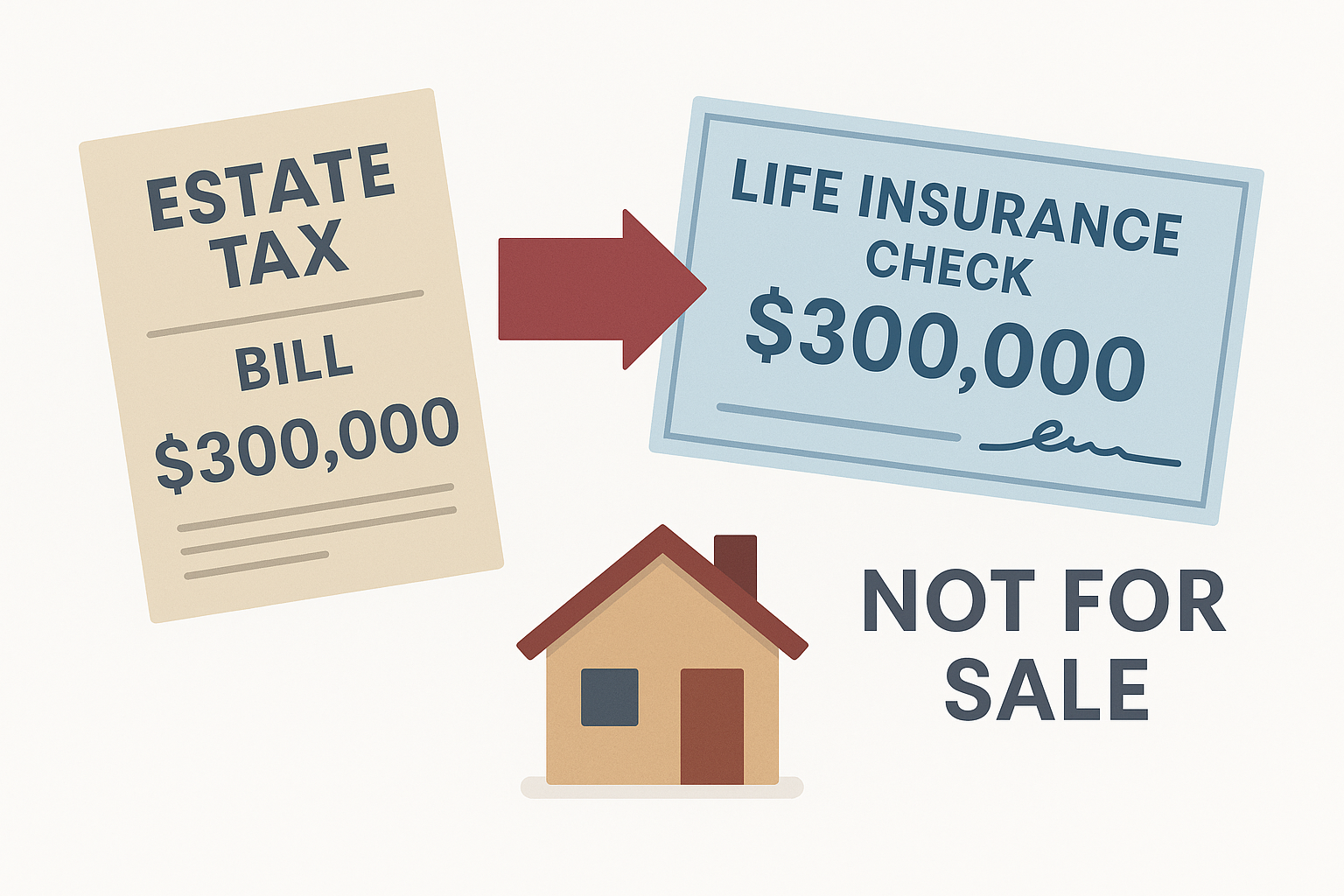

(Part 3 of the “Where Not to Die in 2025” Series)

Estate taxes don’t just hit the ultra-wealthy anymore. With state exemptions as low as $1 million an...

We’ve all heard “nothing is certain but death and taxes”—but for residents of certain states, the co...

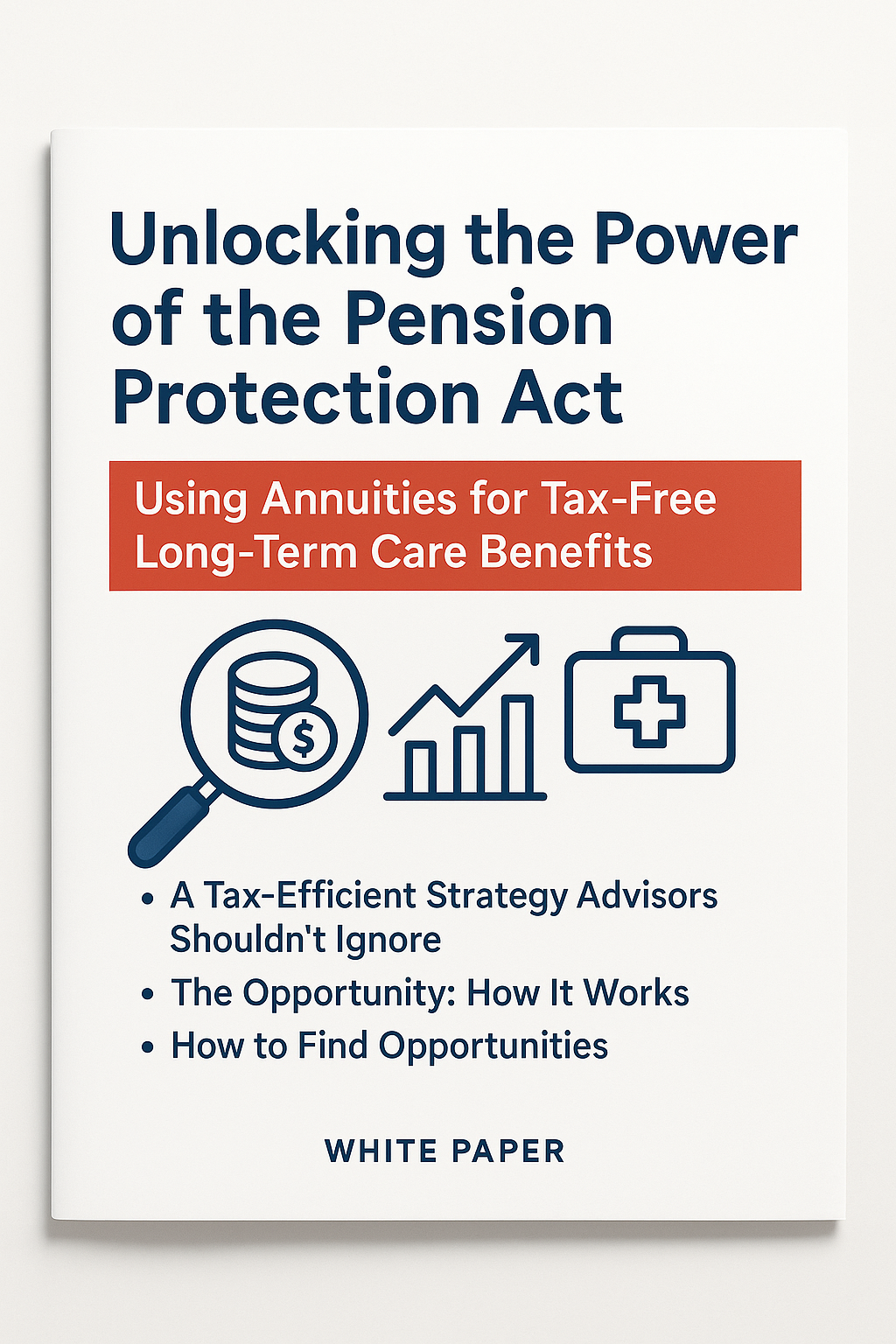

Did you know that many retirees are sitting on idle annuity assets — and missing a massive tax-savin...

In the world of retirement planning, most advisors focus on three things: time, money, and risk. But...

Tax season isn't just about filing returns — it's when clients get hyper-focused on their money. Tha...

Click the button and send us an email, and we'll be sure to give you a call back.